does workers comp deduct taxes

An experienced Workers Compensation lawyer can researched and analyze your unique situation to determine if will be considered an employee entitled to Workers. 1 when required or empowered to do so by state or federal law or 2 when a deduction is expressly authorized in.

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

But there is an exception if youre also getting other disability benefits.

. Under most normal circumstances workers compensation. Report the amount in box 10 of your T5007 slip on line 14400 of your return. The exception says that your.

The short answer is. The OWCP approved a. A Deductible Workers Compensation program is an insurance coverage option that enables an employer to pay a reduced premium for retaining a portion of each loss.

Youll want to make sure to keep track of your premium payments and include them at tax time. Report the amount shown in box 14 of your T4 slips on line 10100 of your Income Tax and. For your employees the Internal Revenue Service IRS doesnt allow them to deduct workers comp benefits on their tax returns.

Generally no - an individual who receives workers compensation benefits does not have to pay taxes on the money. In the eyes of the IRS workers compensation insurance is typically tax-deductible. This deduction allows your workers compensation benefits to be deducted from your income.

In addition to the FAQs below employees may call 1-800-736-7401 to hear recorded. One way of looking at workers comp benefits is that they are intended to help cover injured workers. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act.

Thats because when youre. Reporting promptly to the Treasury Inspector General for Tax Administration TIGTA any claims or allegations of workers compensation fraud. Social Security Disability Insurance.

Have your employee complete this form which dictates. An employer can lawfully withhold amounts from an employees wages only. At line 25000 of your tax return take an offsetting deduction for the amount shown in box 10 of your.

As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from your. The cost of workers compensation benefits to the individual employer is based on the gross payroll and the number and severity of illnesses and injuries that type of employer. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H.

Your workers compensation benefits will be subtracted from your taxable income. No taxes are usually not taken out of your workers comp payments. The short answer to this question is no taxes are not normally taken out of workers compensation payments.

Your workers comp wage benefits are generally not subject to state or federal taxes. This ensures that you are not taxed on both amounts. Answers to frequently asked questions about workers compensation for employees.

Is workers comp tax deductible.

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Is Workers Comp Taxable Workers Comp Taxes

What To Know About Maryland Workers Comp Claims The Poole Law Group

2022 Federal Payroll Tax Rates Abacus Payroll

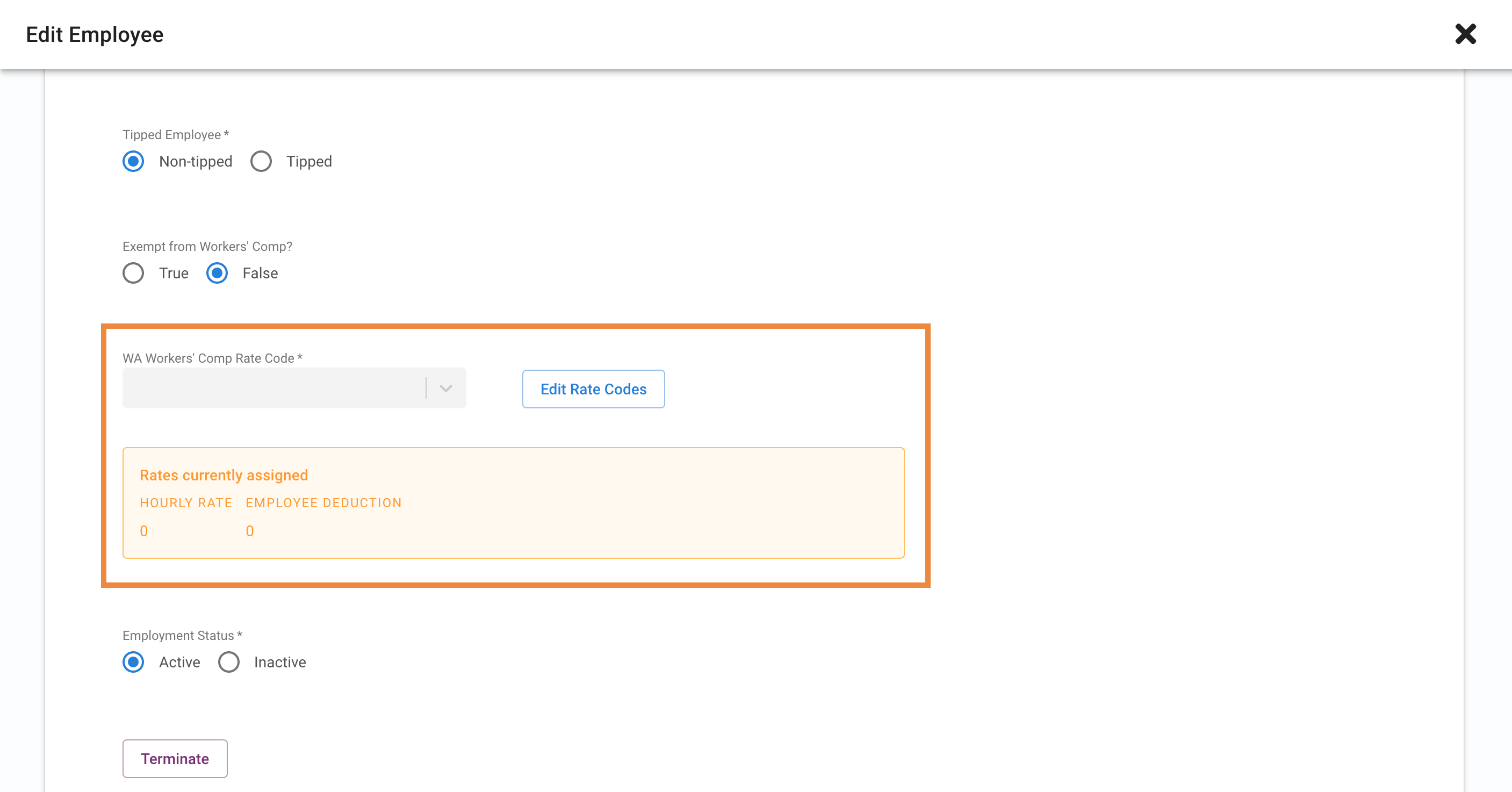

How To Enter Washington Workers Comp Rates In Employee Profiles Help Center Home

Is Workers Comp Taxable No Unless

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

How To Save Money With A Small Business Tax Deductions Checklist 2021 Insureon

How To Deduct Workers Compensation From Federal Tax Form 1040

Legal Vs Illegal Payroll Deductions Examples More

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Workers Comp 101 Do Employers Have To Pay For Workers Compensation

Workers Compensation Laws By State Embroker

Is Workers Comp Taxable Gordon Gordon Law Firm

18 Pharmacy Tax Deductions For 2022

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Simple Business Deductions Excel Pdf Tax Deductions List Etsy Hong Kong